As an Insurance agent, finding leads can be a challenge. It is true, especially in today’s time when there are hundreds of insurance agencies and thousands of agents looking to nab every opportunity to acquire leads. It makes business tough. However, to solve the matter you have to come up with techniques that ensure a steady inflow of leads for insurance agents.

Remember, as there are so many agents, each showcasing their trustworthiness to the prospective clients, you cannot stay back in the game. To be a successful agent, you might resort to all regular lead generation strategies to find clients. You can make phone calls, resort to a referral program or attend networking events, but you will find that some other agents are ahead of you.

If you are amidst such a challenge, you have stumbled onto the right blog. Here, we shall discuss some of the best lead generation methods. Read till the end to know in detail all the strategies that you can leverage to become successful in your profession;

What are Leads for Insurance Agents?

An insurance lead is a prospect who shows interest in getting insurance of some kind. Generating leads for insurance agents is important as these prospective clients bring in revenue when an agent can successfully pass them through the sales funnel.

There are three broad types of insurance leads depending on category. They are health insurance leads, life insurance leads and leads for property insurance. These leads can be hot, warm or cold depending on their level of interest.

7 Types of Insurance Leads

There are several types of insurance leads that an agent can acquire. Each type is a new opportunity. Here we are discussing the most relevant types of leads for insurance agents.

- Life Insurance Leads: These are prospective clients who are interested to sign a policy with the insurance company that the beneficiary will receive a certain sum upon their demise. They pay a regular insurance premium for the purpose. There are also company life insurance leads in this gamut. These leads are directly provided by the company for lead nurturing and conversion.

- Health Insurance Leads: These leads are interested in getting health insurance. If and when they convert, they pay a certain sum (generally on an annual basis) so that the policy covers their medical expenses when they require it. Agents can also generate Medicare supplement leads from this gamut or from the existing customer base.

- Auto Insurance Leads: These are potential customers who show interest in getting insurance for their automobile in case of any damage.

- Home Insurance Leads: These are people who wish to buy a policy to secure their home. These leads are looking to secure their property’s exterior and interior against damage.

- Customer Referral Leads: These leads come to you through referrals of the existing customers. They come to you via word of mouth marketing, thinking you to be a good agent for insurance.

- Third Party Leads: These insurance leads are interested in your services and are generated through other sources like a data aggregator, a publisher, or a partner. You can buy these company leads from a third party by paying a fee.

- Commercial Insurance Leads: These leads are similar to home insurance leads. However, the only difference is that these potential clients show interest in getting insurance for commercial spaces like offices, industry buildings, commercial plants, etc.

5 Best Strategies to Generate Leads for Insurance Agents

If you are an insurance agent striving to make a living out of selling policies, you need to adopt more than the basic approach. Statistics suggest that 69% of people searching for insurance are juggling with options.

As an insurance agent, you have to work two-fold for lead generation and conversion. First, you have to market the insurance company you work for , and second, make the leads believe in your services as an agent!

Hence, resorting to a multi-channel approach for lead generation is the key to success.

We are discussing some of the best strategies of generating leads for insurance agents. We shall discuss each of these strategies in detail so as to give you a comprehensive knowledge on the subject on generation and conversion of leads for insurance agents

- Content Marketing is Useful in Finding Prospects

You would read everywhere on the internet that Content is King! It is rightly so because it is the content on your website, and about your services that has the power to generate more leads.

As an insurance agent, you can start by delving deep into understanding your target audience. Take a note of their pain points and offer solutions in the form of content.

It is best to experiment with content formats while generating leads for insurance agents. Go beyond publishing blogs. Experiment with content formats like podcasts, videos, infographics, and more while marketing your services.

While the publishing platform of most of the content is your website, don’t limit yourself to that. Most insurance agents have taken to other channels, such as social media and third-party websites, to market their services. You should follow suit.

Craft content that inspires leads to take action. Your content should aim to shoot two birds with a single arrow. First, it must offer relevant information, so that website visitors can make an informed choice. And second, promote your services such that leads convert into paying customers.

Let’s walk you through the major types of content you can leverage to get the maximum Insurance leads.

- Blogs Attract Qualified Leads to Website

Creating a blog section on your website holds tremendous benefits. While a non-promotional avenue, it successfully generates organic leads who come to your website.

If you are a life insurance agent, you can write high quality blogs on how life insurance can help people in the family. For a health insurance agent, a few good topics for blogs would be ‘expense for treatment without health insurance’, ‘how to choose the right health insurance’, and ‘How much should medical insurance cost?’ Etc.

These offer valuable information for people who are already searching on the topic. As people tend to trust organic search results, gaining a high rank on the search engine can resultantly give rise to a number of leads.

However, if you do not have a website, try blogging on LinkedIn instead. It is one of the best lead generating platforms for insurance agents.

- Lead Magnet Can Help in Retargeting Leads

Lead magnet is a valuable content asset on your website. It is basically something free that the website offers in exchange for contact details of the website visitors. According to a study, 50% of businesses that used lead magnets saw an increase in conversion rate.

It grants access to that information in exchange for the contact details of the visitor. It can include content number, email address, location, etc. Placing lead magnets can be highly beneficial for Insurance Agents as they can use the information to remarket insurance services to the visitors.

We can safely assume that as these visitors visited an Insurance website, they are interested in some or the other form of insurance. Hence , an email outreach campaign or simple cold calling can bring in conversions.

- Video marketing Has a Higher Engagement Rate

Most people settle for what appeals to the eye. Hence, choosing a strategy like video marketing can be necessary for agents. Video Marketing for insurance agents means creation of useful video content and marketing it on various platforms like YouTube, their own website, etc.

Videos have a higher engagement rate. They make content more digestible. Hence, for people who might not scroll through blogs or fill forms put out through lead magnets, video marketing is a good point to approach.

- Leverage SEO to Find New Clients

Search engine optimization holds the same importance in the virtual world as television and newspapers have in the physical realm.

SEO for insurance agents means employing all techniques that boosts their website’s online visibility. Of course, agents need to have their own website to streamline this process to acquire more insurance leads.

Let’s take a look at the most important components of SEO that an insurance representative can adopt;

- Use Keywords

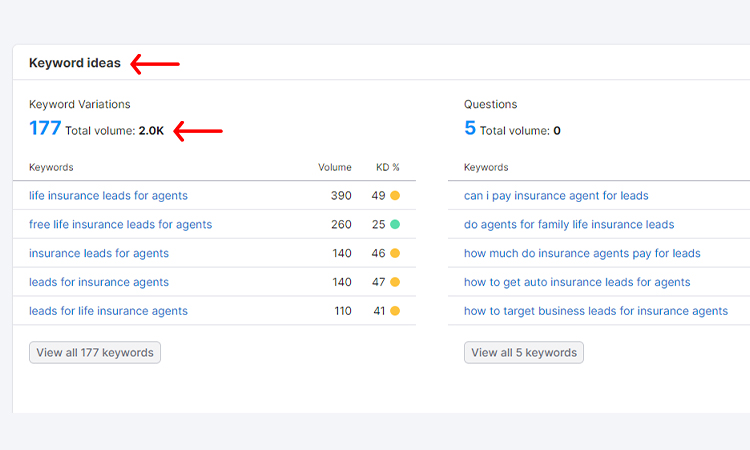

Choosing keywords on which they want to rank their blogs or landing pages is crucial. Keywords here represent search terms that prospective leads are putting on the search engines to find the most qualified agent to take care of their insurance.

Agents can use tools like Google Keyword Planner, SEMrush, or Ahrefs to conduct keyword research. Moz is yet another superb option that offers valuable keywords. If you are new, settle for keywords with moderate competition. Targeting long tail keywords on insurance topics is another good way to rank on the organic results.

- Update Content

Having some of the best landing pages and blogs isn’t enough, even if they are ranking in the first page of the search results. With time , fresh content will take over, and your rankings will drop.

Hence, ensure you update this content with fresh information from time to time. As Google has a special love for updated content, resorting to this lead-generation strategy will fetch positive results. The best part is that it does not take a long while and is cost-effective.

- Invest in off-page SEO

Organic leads aren’t likely to come if your website is buried under scores of links. Hence, off page seo stands prime in your journey.

Optimizing off-page SEO boosts the authority of your website, thereby signaling better expertise in the insurance industry. You can start with building a good backlink portfolio by adding quality backlinks. Ensure that these links are from trusted domains with a credible DA score. It is also better for these links to be from relevant or related niche websites.

- Upgrade User Experience

If you are determined to make the most of organic lead generation strategies, upgrading the user experience is imperative.

Suppose an insurance lead lands on your website, but it takes time to load, or is choppy, will the lead stay?

Probably not. They will find their way back to the search engine before you can blink an eye.

Hence, optimizing the technical aspects like mobile optimization, minimizing page loading time, website security, etc., are vital.

- Take the Social Media Audience into Confidence

Social media is an interactive platform with the power of generating a massive number of qualified leads for insurance agents. With social platforms, you can target an audience and have a wide reach at the same time.

Let’s take a look at the ways you can leverage social media to generate insurance leads;

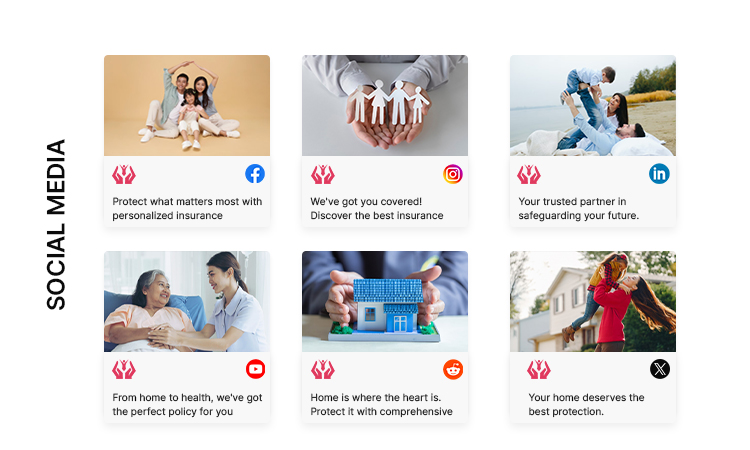

- Create & Optimize Accounts on Social Media

Social media can generate high quality heads, but for that you have to be active on the major social platforms. Start by creating social media accounts on Facebook, LinkedIn, Instagram, YouTube, etc.

Social media leads would only be interested in getting insurance from you if your account looks trusted. Hence, optimize the social handles with a cover picture, display image and an authentic bio stating the purpose of the page.

You can as well add the link to your website in the bio to generate referral leads.

- Post Content Frequently

Once you have created the social media profiles, you need to garner more visibility to attract leads. Hence, one of the best ways is to post at a frequent interval.

Well, if you think that you have to post on a regular basis, that’s not the case. However, posting insurance related posts in the form of texts, images, videos, reels, carousels twice or thrice a week is important for lead generation.

Although social media is a major course of leads for insurance agents, it takes time. If you have some spare time to devote to this strategy, that would work well. Else, you can choose the services of a social media marketing company to help boost your visibility for maximum quality leads.

- Resort to Social Media Advertising for More Leads

SEM is not limited to social profile optimization. There are more ways to generate insurance leads.

You can opt for paid advertising on social media to gain visibility and get more leads. This lead generation technique gives quicker results than waiting for social media and search algorithms to discover your services. However, ad formats like meta adverts and YouTube ads cost money. You may have to pay in terms of cost per click or cost per lead.

- Your Website is the Face of Your Business

There are thousands of insurance agents in the country. Many of these agents work for the same company as you do. So why should anyone choose you as their insurance agent?

To generate and convert leads into paying clients, you have to stand out as someone who offers top-notch service. Explaining the policy in detail and tending to your clients in times of need might not be enough if you want more prospects. Hence, creating a website and optimizing it to the furthest extent is an excellent way to generate leads for insurance agents.

Let’s walk you through a few steps you can take in the direction of creating a superb website to attract clients;

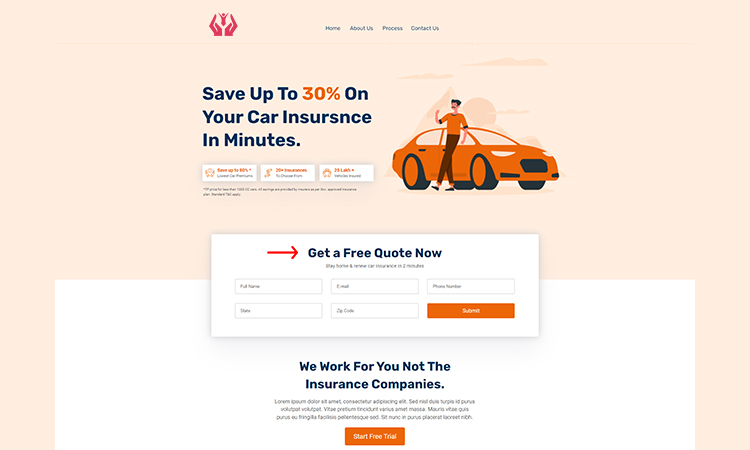

- Create Separate Landing Pages

Suppose you are a medical health insurance agent. In this case, you should create separate landing pages for different plans and policies instead of cramming all the information on the main page.

If the insurance agency offers ten different health insurance policies, you should create ten landing pages. One for each policy. There should be separate service pages for add-ons as well. These landing pages work well and ensure a steady lead flow.

- Focus on Website Navigation

A good website navigation can be a valuable asset for attracting new leads. It boosts dwell time and facilitates potential customers to gather more information.

It heightens user engagement, reduces bounce rate and renders a better image of your services. Hence, finding life insurance leads, health insurance leads, commercial leads and closing insurance sales becomes easier when you have a website with top-notch navigation.

- Showcase Client Testimonials to Assert Credibility

Insurance shoppers who wish to get the best services often look for reviews and testimonials online. In the process of conversion, many clients find testimonials as a driving factor. As reviews and ratings are a direct impression of your service towards your past clients, these count a lot in the lead generation and conversion process.

Understand that people who are already reading reviews of insurance agents are high quality leads. These potential leads can convert with a little persuasion on your part.

So, never skip asking your existing clients for reviews and showcasing them on the website as proof of your services.

- Stir Up the Online Campaign With Paid Advertisements

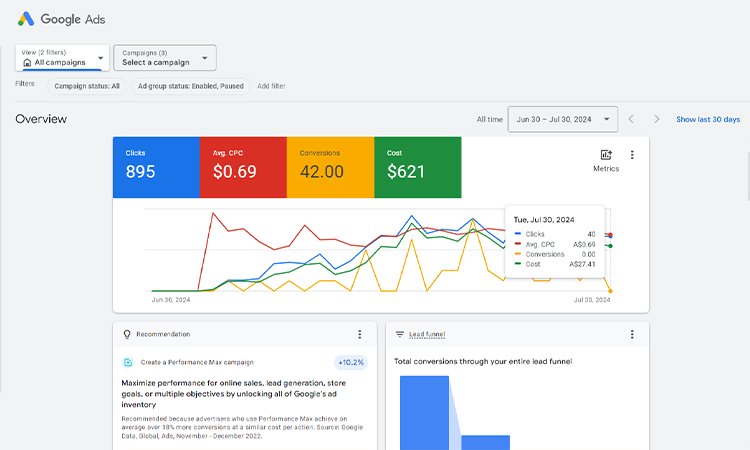

Paid ads is a part of search engine marketing that takes the lowest time to generate qualified prospects who are highly interested in your offerings. If you have some budget, then paid advertising can do the trick in a matter of days.

Let’s have a look at some of the strategies you can take while running a paid marketing for lead generation;

- Target the Right Keywords

As an insurance agent, you are likely to opt for search, display or discovery ads. All these ad formats require you to target and bid on keywords.

For instance, life insurance agents can target keywords like, third party life insurance, best policy in life insurance market, cost of life insurance sales, best life insurance agents near you, etc.

Remember, the target keyword should not be the one you think fits. Instead, it should be the ones prospective customers are looking for.

- Creating a Compelling Ad Copy

Generating leads through paid ads is a rather lofty measure for an insurance agent. Nonetheless, it is a sure-shot one. However, it will only work if the target audience is attracted to the ad copy. This is especially true if you are running a display or discovery ad campaign.

Hence, try to create the ad copy as interesting as you can. Also, it should have all the relevant information regarding your service, the type of insurance you sell and more.

- Set a Budget

Paid ads charge you on the basis of per click, per lead or per impression. Hence, there is a cost for every lead you acquire. Hence, it is also important that you set a daily or monthly capping on the paid ads. Otherwise, the bill would be an enormous one, resulting in unexpected losses.

Final Words

If you are an individual insurance agent trying to set foot in the industry, the above-discussed strategies should garner you enough leads for insurance agents. If you are just starting off, you might not need all the five lead generation strategies we have discussed for insurance agents. However, if you are keen on being a super successful agent, resorting to all the strategies will fetch good results.

If you have some knowledge on digital marketing strategies for lead generation, it will work in your favor. If not, take the help of a good lead generation company. Is not very hard to find one. Most lead generation companies that are good offer tailored solutions that should meet your requirements.

Additional Resources: